Saturday, June 17, 2006

U.S. Economy Feeds On Your Debt

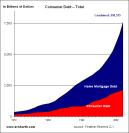

Consumer spending used to be part of a feedback loop that recirculated cash and kept the economy healthy. The more that little guys like us spent, the bigger the profit of the corporations, the more both the bosses and the little guys were paid, and the more we all ended up spending. But that has completely changed. Corporations are no longer redistributing their increased profits. Whatever doesn't go into the pockets of the bosses just sits in corporate treasuries. It has been estimated that $2 trillion in cash is available to American corporations, but their bosses are doing nothing with it. They are certainly not using it to pay us more so that consumer spending increases through the normal means. Yet it grows by leaps and bounds nonetheless. Between 1994 and 2004, its share of the GDP expanded by nearly 70 percent, even though real income remained essentially flat for five years in a row up through 2004, with income actually falling for the bottom 95 percent. The bottom 95 percent! Where is the money coming from? From our debt, that's where. The ratio of consumer debt to disposable income went up from 67 percent in 1975 to 127 percent in 2005. Mortgage debt has increased dramatically, abetted by predatory mortgage lending practices. So has credit card debt, with interest rates switching from fixed to variable and rising steeply as a result. All this is happening at the same time that Congress has passed laws to severely restrict personal bankruptcies, closing off the escape hatch for indebted families just when it is needed more than ever. We are rapidly turning from a nation of free men and women to one of virtual indentured servants, all to satisfy the cowardly and compulsive miserliness of our corporate masters.

"The Household Debt Bubble" from Monthly Review