Friday, June 30, 2006

The Retirement of Retirement

Despite rampant age discrimination, millions of American workers will be forced to work through their old age anyway - unless drastic changes are made to the system. Americans between the ages of 55 and 64 have accumulated, on average, only $78,000 in assets beyond the value of their homes. Of those in that age group who have 401(k) plans, the median amount accrued is only $23,000. Private pension plans would be a great boost, but most of those are rapidly disappearing. What pensions do exist go disproportionately to the affluent, with 70 percent of all retirement funds held by just 40 percent of workers. Experts believe that between $200,000 and $300,000 in savings - in addition to Social Security (which some would like to take away) - will be required for even a modestly secure retirement. Add to this the inevitable rise in the cost of living and the price of health care, and the prospect of a comfortable retirement seems like a total fantasy.

Working instead of retiring would not be so bad, provided one was healthy, and the work was meaningful. In other words, a suitable reward for experience rather than a humiliating demotion to an economic second-class citizenship. In previous centuries, professionals, craftsmen and farmers were allowed to work as long as they were able. As a result, many enjoyed a kind of "green old age". It was only with industrialization, with its brutal mechanistic pace, that older people started to be pushed out of the workplace. According to an economist 100 years ago, "The old man today, slow, hesitating, frequently half-blind and deaf, is sadly misplaced amidst the death dealing machinery of a modern factory." Excluding older people from fruitful participation in the economy simply because they are old began with our modern era, and it continues. Nowadays, of course, the prejudice against the old is colored by the demands of the service industry. Older folks are not pretty enough, their voices too raspy, their teeth too stained and snaggly, their grasp of pop culture, financial instruments or software languages not current enough for them to compete amongst the young. They may be fit to serve as greeters at Wal-Mart perhaps, as in a parody of grandparents welcoming home their progeny, but that is just about it.

Here is where the blessings of a low birth rate come into play. As corporations run short of labor among the less populous post-Baby Boom generations, they will need to turn increasingly to older people. Or at least that is the fond hope of many, although others believe that older workers will still be shunned in favor of a dramatic increase in foreign outsourcing. Nevertheless, the best case scenario brightens the imagination. Older workers, with their vast experience and their health still intact, may find themselves with opportunities that eluded them in their youth, and come into their own at long last.

"Sweating The Golden Years" from The Wilson Quarterly

"Paying For It" from The Wilson Quarterly

"What's A Retirement For?" from The Wilson Quarterly

Thursday, June 29, 2006

How To Blend In On The Job

Here are some tips for dealing with office politics:

1) Think before you act (or speak) - Be diplomatic, lie and dissimulate. Suppress your true feelings at all cost.

2) Nurture the stakeholders - Flatter, suck up, wheedle your way into the hearts of both the important and the merely useful. Gather ye brownie points while ye may.

3) Keep your enemies close - In other words, apply rules 1 and 2 to those whom you despise the most. It is interesting that this is one of the most cherished mottoes of the Cosa Nostra.

4) Imitate the successful - Ignore your own instincts and conform. Do not be original. Copy. Monkey see, monkey do, monkey get raise. Corporations are like Hollywood producers: they always feel most comfortable with a remake.

5) Play the game - learn how to gossip, how to back-bite, and how to get even.

Seriously though, the above remarks are just my own cynical take on some very necessary survival tactics. Visit the link below for more of the same with a straighter face.

"5 tips for the office" from The Indianapolis Star

Wednesday, June 28, 2006

U.S. At The Mercy Of The Mega-Rich

52 Senators voted for an increase in the minimum wage from $5.15 an hour to $7.25, but the Republicans killed it with a filibuster. At the same time they pushed through a bill for a repeal of the estate tax. Inheritances up to $5 million will not be taxed, and any amount beyond that will be taxed only 15 percent. So far, the supporters of the bill need only three more votes, and the scuttlebutt is that they will attempt to woo the Democratic Senators of Washington State with tax cuts to the timber industry. If this bill passes, it will deprive our deficit-beleaguered federal government of 760 billion tax dollars over a period of ten years - money that could have been spent to boost health insurance, fund works programs, and provide aid for child care, education and home owners. Behavior like this clues us in ever so well on whom our Congressional leadership really supports. And their actions aren't just hurting the poor.

According to Robert Kuttner, "The right has managed to savage the institutions that produced increasing opportunity and a broader middle class in the decades after World War II -- minimum wages, trade unionism, job-security, decent health and retirement plans, affordable college and housing, Social Security that rose with inflation, and economic regulation to keep Wall Street from grabbing most of the winnings. The middle class hasn't been so insecure since the depression. But today, unlike 1937, this epic reversal is off the political radar screen. The insecurity is experienced privately rather than as a national issue."

Former vice-presidential hopeful John Edwards has recently spoken out on the moral imperative to end poverty in America, but the real divide is not between the poor and the rest of us. It is between the rich and the rest of us. Four out of five Americans have not moved forward at all economically since the 1970's, while the top one percent have benefitted beyond their wildest imaginings - or anybody else's wildest imaginings either. Politicians love to speak for the majority, but who is speaking now for that forgotten 80 percent?

"Survival of the Richest" from The American Prospect

Tuesday, June 27, 2006

The Corporate Tough Chick

Men and women tend to manage differently. Powerful men dominate from a distance, delegating authority to lessers while remaining personally aloof. Powerful women are often collaborative, working closely with their underlings yet at the same time staying in contact with their mentors and former colleagues. This style of management can have extremely beneficial effects when applied correctly. However, it can be particularly destructive when abused. The closely collaborative style of female managers gives them access to personal information that can fuel hurtful remarks and outright betrayals, and the Medusa head of their many connections is a formidable resource which they can turn against their enemies.

"A Tyrant Boss, Even Without the Y Chromosome" from the New York Times

Monday, June 26, 2006

CEO Pensions Grow As Your Pension Shrinks

Corporations complain about the fiscal pressure from pension costs. What they don't mention is that the real pressure is coming from executive pensions, not from yours. As corporations progressively shrink, freeze or terminate worker pensions, the pensions of top level executives continue to grow unchecked, on a parallel track with their yearly compensation while still employed. However, since corporations are not obligated to separate executive pension costs from worker pension costs in their financial reports, this disparity goes unnoticed. Executive pension liabilities have reached $3.5 billion at General Electric (Jack Welch's old employer), $1.8 billion at AT&T, $1.4 billion at GM, $1.3 billion at IBM and Exxon, and $1.1 billion at Pfizer and Bank of America. Occasionally, pension liability for a single executive may reach $100 million. Again, that's for a single person. Yet these bloated nest eggs are hidden among your pension costs, with the effect that your pension, not theirs, gets blamed for putting a permanent drag on corporate profits.

"As workers' pensions wither, those for executives grow" from the Pittsburgh Post-Gazette

Sunday, June 25, 2006

Corporate Crybabies

The Business & Media Institute has been watching a lot of TV lately, and they don't like what they see. Businessmen are portrayed in a negative light, they say, citing plots that feature "criminal CEOs and murdering MBAs". All I can say is: Oh my goodnish! Po' wittle babies, you're tho thenstive! How you thuffer from being teased! Well, look at it this way, dudes - getting teased is better than getting taxed. Even the crimes that you get, ahem, "accused of" are ridiculous grand guignol kinds of acts that have nothing to do with what you really do to the American people. No TV crime show I've seen lately ever dwells on the quiet atrocities of downsizing, bullying or brainwashing - not to mention the escalating inequality between your compensation and the suppressed wages of your underlings. Thank God the evil media doesn't rub your nose in that. Besides, almost every group has had a bad image in the media at one time or another. You have been relatively fortunate. You have acquired a bad image not for what you are, necessarily, but for what you do - and you can always change that. Your depiction as murderers and conspirators may have scant literal truth, but it has plenty of figurative truth. You may not be taking lives, but you destroy livelihoods as often as you eat breakfast. If you want to be portrayed as saints, then act like saints. At least share your profits, for the love of Christ.

"On TV, There's a Killer Corporate Image Problem" from the Washington Post

Friday, June 23, 2006

Billionaire Corporate Crimefighter Launches Website

Batman lives? Perhaps... Billionaire owner of the Dallas Mavericks, Mark Cuban, is apparently a bit of a maverick himself, at least in the context of his income bracket. He is starting a news blog dedicated to exposing corporate fraud. It will go live next month and will be called Sharesleuth.com. His team will research suspect corporations. He will buy or sell shares of stock on the basis of what he learns. Then afterwards he will publicize the dirt he dug up on his website. Some see this as a breach of journalistic ethics, if not quite in the league with insider trading. He counters this charge by saying, "Isn't the smart investor the one who does their research and then makes a buy or sell decision? In our case, we will do the same thing, only we will publish why we are doing it." Hmmm...

"Web Watch: Cuban backs corporate fraud exposé website" from silicon.com

"Cuban Backs White-Collar Crime Investigation Site" from Forbes

Thursday, June 22, 2006

The History Of American Money

I found a series of articles about money at a historical web journal called Common-Place. Very educational, and a veritable goldmine of trivia nuggets. You will learn that bookkeeping has always been defined by something other than reality, that 17th century Brits sold their silver coins abroad because they were worth more as a commodity than as currency, that the forefather of American banking was an aesthete who wanted banks to look like Greek temples, that the New England Puritans stopped worrying about usury and learned to love the bond, and that Uncle Sam didn't print his own money until the Civil War. And much, much else... The articles are free, too - so you don't have to pay money to read about it.

"Special Issue On Money" from Common-Place

Wednesday, June 21, 2006

Make Your Millions Now, Before Layoffs Kill You...

A word to the wise for all corporate youngsters. Make your millions now because at fifty you will be laid off - and you will very likely die a gruesome death from the effects of stress. Even if you would otherwise live to be ninety, "late life" begins at fifty according to the corporate clock. Mortality will then pursue you like a jogging CEO. A new study conducted over a decade rife with layoffs confirms the obvious. Among old tuskers 51 to 61, layoffs are killers. Of those who suffered heart attacks, 10 percent had them after becoming jobless. Of those who suffered strokes, nearly a quarter blew their arterial fuses while unemployed. Downsizing may seem like murder to some of us softies with that anachronistic trait known as a "conscience", but a Jockocratic CEO of our personal acquaintance was recently heard telling his cronies how the ancient Goths burned themselves on pyres once they got too old for the practice of looting and pillaging. Baritone laughter abounded soon afterward, then one dude remarked, "What's in your wallet?" And another said, "It ain't anything we paid you lately - that's for damn sure..." And they all laughed again.

"Late-Life Job Loss Raises Heart Attack Risk" from msn.com

Tuesday, June 20, 2006

Number Of Big Yachts Doubles In 10 Years

The number of pleasure craft over 75 feet long has doubled over the last decade. Some 2,500 of these monsters are afloat. Larry Ellison has one 453 feet long, while Paul Allen's is only 414 feet - but at least his has a recording studio, a submarine and some helicopters. Larry Ellison once purchased a fighter jet for his teenaged son, so one can assume that his own yacht is scarcely less deficient in the aviation department. And these guys often like to be on their behemoths of buoyancy alone. They cost a couple hundred million to buy, and 20 to 30 million a year to man and maintain. Who says size doesn't matter?

"World's fleet of private mega yachts growing" from MSNBC

Monday, June 19, 2006

The Worrying Class

The spirit of the middle class teeters between anxiety and aspiration even in the best of times. These days though, I think we're tipping more towards the former. What with Iraq, soaring gas prices and a superficially healthy economy that boasts growth and low unemployment, but which also features job insecurity, flat wages and rising consumer debt, worry becomes us. Americans don't - or can't - stay at their jobs as long as they used to. The average length of time in one job has changed between 1983 and 2004 from 5.9 to 5.1 years for males aged 25 and over, from 7.3 to 5.2 for male workers aged 35 to 44, and from 12.8 to 9.6 years for males aged 45 to 54. Although shorter spans of employment at one place can suggest a vigorous economy with lots of opportunity, the constant change by itself can be stressful. Besides, why move even when times are good if you're not fundamentally discontent? Another worrisome issue is the increased volatility in income, which has brought rapidly shifting fortunes to individuals as well as rising gaps in compensation across the society as a whole. Family income volatility has gone up 50 percent in the last two years and is now three times greater than what it was in the 1970's. Even when they remain employed, middle class workers often lose a substantial portion of their previous incomes when they change jobs. For those who experience such a drop, the current median decline is 40 percent, compared to 25 percent thirty years ago. On the other hand, many economists view rising income inequality as proof of the power of an education, since most of the higher paying jobs go to those with college diplomas and advanced degrees. To cushion the blow of downward mobility, as well as to enhance access to higher education, some reformers suggest such schemes as education tax credits, wage insurance and even endowing newborns with $500 bank accounts so they can begin saving for retirement as soon as they draw their first breath. Check out the link below for a discussion of middle class economic worries and how they might be alleviated.

"Anxiety Attack" from U.S. News & World Report

Saturday, June 17, 2006

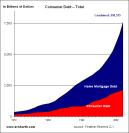

U.S. Economy Feeds On Your Debt

Consumer spending used to be part of a feedback loop that recirculated cash and kept the economy healthy. The more that little guys like us spent, the bigger the profit of the corporations, the more both the bosses and the little guys were paid, and the more we all ended up spending. But that has completely changed. Corporations are no longer redistributing their increased profits. Whatever doesn't go into the pockets of the bosses just sits in corporate treasuries. It has been estimated that $2 trillion in cash is available to American corporations, but their bosses are doing nothing with it. They are certainly not using it to pay us more so that consumer spending increases through the normal means. Yet it grows by leaps and bounds nonetheless. Between 1994 and 2004, its share of the GDP expanded by nearly 70 percent, even though real income remained essentially flat for five years in a row up through 2004, with income actually falling for the bottom 95 percent. The bottom 95 percent! Where is the money coming from? From our debt, that's where. The ratio of consumer debt to disposable income went up from 67 percent in 1975 to 127 percent in 2005. Mortgage debt has increased dramatically, abetted by predatory mortgage lending practices. So has credit card debt, with interest rates switching from fixed to variable and rising steeply as a result. All this is happening at the same time that Congress has passed laws to severely restrict personal bankruptcies, closing off the escape hatch for indebted families just when it is needed more than ever. We are rapidly turning from a nation of free men and women to one of virtual indentured servants, all to satisfy the cowardly and compulsive miserliness of our corporate masters.

"The Household Debt Bubble" from Monthly Review

Friday, June 16, 2006

Corporate Interrogation Techniques

Forget Guantanamo - we have detainees in corporate torture chambers now! According to Ralph Nader, many companies retain agents trained in police interrogation tactics. When an employee is suspected of a petty crime, the security guards take him into a room where he is bullied for hours at a time. None of this is controlled by any laws on the books. There is no Miranda warning to protect an employee against the consequences of anything he says, there is no right to have an attorney present, and blatant deception and false evidence are freely employed to exact a confession. AutoZone recently sequestered an employee accused of stealing $800 in a closed room for three hours, promising to let him keep his job only if he confessed. To save his job, which he needed to support his family, he did confess - even though he was innocent of the charges. AutoZone nonetheless fired him anyway, after subtracting the missing amount from his final paycheck. The employee later sued, and was awarded a $7.5 millon settlement by the court. Here is a yet another illustration of the undemocratic nature of the corporate state, and its totalitarian power over our lives.

"A Corporate Abuse- Coerced Confessions" from IndyBay

Thursday, June 15, 2006

Older Americans Face More Mortgage Debt

Older Americans are carrying more mortgage debt now than they had in previous years, and they will carry even greater levels of debt in the future. The causes of this phenomenon are multiple. Americans get married later now, which pushes up the age when they buy their first houses. They also get divorced and remarried at greater rates, which results in selling (or at least leaving) their first house and perhaps buying another. Americans also have to shell out a larger portion of their income to buy a house than in previous generations, which not only increases the rate of overall mortgage debt but induces home buyers to opt for 30 year rather than, say, 15 year mortgages. This extends the period of debt well into their later years, as well as increasing their cumulative debt even more. Add to this the disconcerting general trend of increasing debt of all kinds, and it doesn't take a Nostradamus to foresee the vast majority of middle class Americans as debtors until the day they die. Mortgage debt is, in fact, exacerbated when homeowners take out second or even third mortgages to relieve their additional debts. The only leverage they have is the hope that the value of their homes will appreciate, enhancing equity that may later be translated into cash at some elusive point in their golden years. But if the real estate market crashes, and remains flat, that sole advantage is gone and millions of older Americans will be in a world of hurt.

"Mortgage Study - Americans Will Carry Mortgage Into Golden Years" from MortgageNewDaily

U.S. Tech Firms Downsize In India

Sun, Apple, Intel, Seagate and other American high tech firms have begun downsizing in India, creating job security fears among the nation's IT work force. These firms are downsizing in the United States as well, of course - but the thrust is perhaps more global now than it had been in previous cost-cutting campaigns. Folks overseas must remember that when they take a franchise on American money and American business, good old American corporate decimation will also become part of the bargain. One problem with India may be their success in the outsourcing market. Indian techies were - certainly initially - paid very much less than their notoriously flabby and dull-witted American counterparts. However, it was projected even at the start of the latest outsourching push some years ago that, with all the costs factored in, an overseas Indian techie cost an American firm only about 22 percent less to hire and retain. As the outsourcing business has grown in the last five years, so has the demand, and Indian techies make more dough than they used to. They're not so impoverished and downtrodden any more. Thus it is time to downsize them, but maybe the consequences of this subcontinental "shock to the system" won't be all bad. Our sincerest hope is that workers overseas will learn to empathize with their American peers and help found a global movement for "white collar rights".

"IT firms begin downsizing in India" from SiliconIndia

Wednesday, June 14, 2006

The Phoenix or The Cuckoo

The American people have pretty much figured out by now that the economic agenda of the GOP favors the tiny minority of the ultra-rich over the welfare of the rest of us. Their strategy in the past has been to bait the hook with a fulsome and disingenuous invocation of Faith, Family and Freedom, and then reel in their prey with economic policies which they know the American public will not truly understand. But that's all over now. Everyone understands all too well how few Americans those policies are intended to benefit. Now is the moment for the Democratic party to recapture the flag. The article at the link below summarizes two competing Democratic tactics - that of the cuckoo, who will lay the eggs of social reform in the nest of conservatism, and that of the phoenix, who will rise from the ashes of the Democratic party's past defeats with a new and more dynamic liberalism. Which would you choose?

"Markets And The Common Good" from TomPaine.commonsense

Tuesday, June 13, 2006

U.S. Soft On Corporate Crime

Below is a link to a nice little litany of corporate crime in America. There are some "where are they now?" updates on various money-mad malefactors of bygone times. Remember Ivan Boesky? He was the model for Gordon Gekko, the Michael Douglas character in Wall Street who declared, "Greed is good." For his insider trading, Boesky did minimal jail time and walked away with 25 million. How about Michael Milken, the Junk Bond Bandit? Originally sentenced to ten years behind bars, he did only twenty-two months, most of that in community service - and retained a cool $1.2 billion of his criminal earnings. An average Joe robbing a gas station for 500 bucks is likely to do more time in jail. Why? The rich guys can hire the best lawyers. They can't fool the American people though. Surveys report that 90 percent of us believe corporate executives wield too influence over government, and only 2 percent consider corporate bosses "very trustworthy". Maybe the times, they are a-changin', as the poet says.

"United States: Still Soft on (Corporate) Crime" from Axis of Logic

Incidentally, check out the cool Corporate Crime comics at the link below:

Corporate Crime comics

Monday, June 12, 2006

The Latest In Cubicle Design

The open office floor plan originated forty years ago to accommodate quickly expanding businesses that lacked the wherewithal to build offices for every schnook they hired. This innovation spread far and wide as corporations flattened out their hierarchies by stripping away layer upon layer of middle management and flung everyone into the same broad carpeted field. A big open space to hold us all, guarded by the occasional corner office. This was, I believe, approximately the same layout that Andersonville Prison had during the Civil War. Be that as it may, corporate employees were rarely left completely unshielded from the elements. Those cloth-bound pens we call "cubicles" evolved. Small enclosures do not fit the American psyche very well, but most of us had little choice in the matter. Even as middle class homes ballooned into $500,000 starter castles and everyone began driving Ford Excretions, our cubbyholes only got smaller and smaller. Outgoing young people nowadays would prefer to dispense with cubicles altogether, and bask beneath the fluorescent corporate sun in vast open spaces. Privacy still matters to many however, so cubicle designers are engineering a compromise. The newest new things in Corporate Cageware are translucent or transparent enclosures with curvilinear walls and sliding doors that seal off the occupant from ambient noise, but which allow both the occupant and his or her bosses to look in and look out. Sort of like the Cone of Silence in Get Smart perhaps, or the plexiglas noses of World War Two bombers. In the future we will be able to actually see the Downsizers coming at us from twelve o'clock high.

"Office thinking outside the box" from the Chicago Tribune

Sunday, June 11, 2006

The Myth Of The Paperless Office

Thirty years ago, predictions of the "paperless office" were all the rage. All information would be channeled through the computer, where it would be stored forever and from which it could be retrieved instantly. At least, that's what the management consultants and the automation guys told us. That day has most emphatically not come to pass. The fact is, people in office jobs like multiple pieces of information in front of them at all times. They also like the idea that these pieces of information are individually mobile and detachable. With computers in the old days, you really couldn't have multiple pieces of data right there in front of you. Nor were computers mobile - not even desktop PC's. You could say that the Microsoft Windows standard of the Multiple Document Interface (MDI) is the closest equivalent to a desk with dozens of different notes and memos spread across it. And laptops, iPods and the like give computerized information the kind of mobility it never had before. But even with these improvements, there's nothing more natural than something on paper. You don't have to power up a machine or fiddle with a keyboard to check your notes - all you need is to glance downward now and then, use your hands a little, too, and you're all set. Worst of all is that electronics distracts us from the people we're talking to way more than paper does. That's why our bosses don't really like it - as it distracts us from them. But it's also why we don't like it either. We cherish the tactile reassurance of something that is physically at our disposal. The myth of the paperless office is yet another example of how those self-important swamis who prognosticate so confidently about the future of American business are out of touch with the human side of the equation.

"The Myth of the Paperless Office" from The Globe & Mail

Friday, June 09, 2006

Emptier Pockets For A Third Of Us

According to a survey conducted by the career management firm Graham Holland, almost a third of white collar workers changing jobs during the last year took pay cuts. The firm places the blame on a lack of professional consultation, but then they would do that. We blame the economy. The survey also found that two thirds of job seekers used the Internet in their search, and suggested that the Internet is likely to play an even larger role in the future. The Internet serves as a handy tool for researching a company prior to an interview - as well as a medium for networking. Even strangers can provide helpful advice when approached via the web.

"Survey Tracks Salary Cuts and Other Trends" from Send2Press Newswire

French Version Of "The Office"

A French TV show called Le Bureau replicates Britain's The Office, which already has been cloned under the same title in the United States. "Vive la difference" is not quite the right phrase for the Gallic version, as white collar dreariness is a worldwide phenomenon. There is a "boss from hell", who nonetheless dresses better than his British counterpart. Racism is a frequent theme, and so is sexual harassment - although Le Bureau, being French, takes a lighter approach to this problem than Anglo-Americans would. The cast have dialect coaches who teach them business-speak (now there's an idea for a second career), and the worker bees surf the Internet just like everyone else.

"Cheese and whine in French 'Office'" from The Salt Lake Tribune

Thursday, June 08, 2006

Breaking Your Piggy Bank

Corporations have moved progressively away from pensions simply because the laws will allow them to do so, promoting 401(k) plans instead. They see 401(k) plans as the way to go because they are not legally obligated to contribute, you take all the risk, and they can always cajole you into buying shares of their stock even if the value of that stock is worthless. Congress has wholeheartedly approved this mass flight from corporate responsibility. In fact, it has consistently abetted corporations in their efforts to force pensions, and other benefits, into extinction. Legislators have re-drafted pension rules to encourage the underfunding of retirement plans, and have enacted bankruptcy laws to allow corporations to suspend health insurance and other benefits to their former employees. The Employee Retirement Security Act (ERISA) was passed in 1974 to prevent corporate executives, accountants and lawyers from using your pension as a source of cash - a scenario comparable to a stingy daddy robbing his own kid's piggy bank. The spirit of that act has utterly vanished in Congress, and a pension reform bill has been introduced to remove what restrictions remain to protect retirement plans from such predatory conflicts of interest. That's not all. The new bill would also bar unions from renegotiating pension agreements at the bargaining table, while enabling employers to "freeze" an employee's pension, not allowing further amounts to accumulate.

"Ripping off retirement: the big pension swindle" from Newsday

Wednesday, June 07, 2006

Bracing For The Cut

If you sense that layoffs are coming, here are some tips on how to prepare.

1) If you need to go to the doctor or the dentist, do it now while you still have benefits. Then, when you leave, go on COBRA to keep your coverage for as long as you can.

2) Update your resume, and start networking.

3) Negotiate a severance package - if you can.

4) Make sure to take your 401(k) investments with you. Corporations have a way of reabsorbing them into their own blob-like treasuries.

5) Put away your credit cards until you start working again.

6) Leave on good terms, if at all possible. Even if you totally despise the sons of bitches - and who the hell can blame you? - you must remain in Smiley Face Mode to avoid eating next year's Thanksgiving dinner at The Mission.

"Expert advice: prepare for layoff" from The Coloradoan

Tuesday, June 06, 2006

Interview With Barbara Ehrenreich

Barbara Ehrenreich, author of workers' rights classics Nickel And Dimed and Bait And Switch, now has her own blog. Recent entries discuss Enron, the ostracism faced by laid off white collar workers, and how the sterility of the modern office environment impoverishes the central nervous system. In a recent interview, she turns her sharp eye and even sharper tongue on the rising gap between rich and poor and the fact that even managers and professionals can lose their jobs at any moment. She recounts that her British publisher told her that Britons have a hard time understanding that anyone can be fired or laid off for no reason. They cannot conceive of the American notion of "employment at will". The fact is, says Ehrenreich, that in the United States "you can be fired for a funny expression on your face". Most of all, she laments the internalized self-hatred of all the "working" classes, whether blue collar or white collar, who are taught to blame themselves for the abuses they endure. She believes the ultimate solution for the victims of corporate decimation is to find solidarity with one another, and to organize against their common enemy. We already have a class war on our hands, she says, and we aren't the ones who started it.

Tomdispatch Interview: Ehrenreich, The Prey and the Predators

Barbara's Blog

Monday, June 05, 2006

Jumping The Shower Curtain

Here is a new phrase from the world of business news. When corporate Neros push their greed so far that even hard-working churchgoing Republicans shake their heads and want to cry out, "I won't take it anymore!" - that's called "Jumping the shower curtain." It comes from when Tyco king Dennis Kozlowski installed a $6,000 shower curtain in his mansion while he was ripping off his shareholders for millions. Read about the latest vogue in corporate grotesquerie - and behold the awareness burgeoning in the hearts and minds of ordinary Americans.

"Super-rich set sights on a really gross profit" from the Baltimore Sun

Oil Schtick

Federal laxness at controlling mergers allows oil companies to consolidate. Consolidation breeds oligopoly, in which a pseudo-"free market" composed of a handful of monster companies form a joint monopoly among themselves. Without competition, refineries can limit the supply of gasoline as they choose, and still squeeze the consumer. Federal laws that allow variances in gasoline regulations from state to state, and between town and country, inhibit interstate commerce in gasoline and further reduce the number of competitors in local markets. This enhances the power of the oil oligopoly and drives up prices even more. We ask, Why not impose the same gasoline regulations nationwide, and therefore increase the number of suppliers able to sell gas in any one place? Come to think of it, why should we allow bad gas - substandard air-polluting gas - to be sold anywhere? Force all gasoline manufactured in the U.S.A. to meet the same standards, and ultimately our gas may be both cleaner and cheaper.

"Pumped Up" from The New Yorker

Sunday, June 04, 2006

Dicked Over Down Under

We imagine that rising income inequality and the uncontrolled acromegaly of the executive paycheck are peculiarly American problems, but they happen Down Under as well. The business news from Australia and New Zealand is depressingly familiar. The CEO of a leading Australian bank rakes in two percent of its net profit, an increase of 164 percent in the last three years. The income share of the top one percent of Aussies is now higher than at any time since 1951. Who makes up that top one percent? It's mostly businessmen, according to the Sydney Morning Herald. Most professionals have not shared in the bloated salary increases, and have actually seen their income decline relative to other Aussies over the last eighty years. High court judges earn just eight times the average wage today, while they earned 17 times that in 1921. Top public servants earn just five times the average wage, while they earned ten times that in 1921. Even politicians have seen their relative income decline by half in the same time period. In contrast, executive earnings have increased from 27 times the average to 98 times the average just since 2002. Some claim that chief executives - like sports figures, show business types and high-flying attorneys - are simply claiming the rewards of their "superstar" status. But sometimes they benefit more from luck than from performance - as in the case of oil company executives skimming the cream off escalating petroleum prices. Even when they are rewarded for good luck, they are rarely penalized for either bad luck or incompetence. The closed guild of top executives is to a large degree responsible for setting the income standards of its own profession, irrespective of free market conditions. Fully one half of the profit from productivity gains in the United States since 1966, for instance, went into the pockets of the top 10 percent, while real wages for the bottom 90 percent fell. The only silver lining in these clouds wafting up from The Antipodes is our realization that the wages of sin for "globalization" will inevitably be global awareness.

"The super rich CEOs" from the Sydney Morning Herald

Friday, June 02, 2006

Say No To Workplace Bullies!

A new organization, the Workplace Bullying and Trauma Institute based in Bellingham, Washington, is leading the fight against psychological harassment in the workplace. One in six corporate employees report being bullied. This is three times the incidence of sexual harassment, and 1,600 times that of workplace violence - yet there is scant legislation against workplace bullying, and what exists is too weak to slow it down. The social dynamics of the phenomenon are not what you would expect. Female bosses make up 58 percent of these bullies, which may be attributed to the need they feel to assert their authority in a male-dominated work environment. The victims of the bullying, on the other hand, are rarely either slackers or weaklings. In fact, they are often their team's most capable and effective performers, which suggests that the bullies are motivated by envy or the fear of competition. In addition to being wholly counterproductive, workplace bullying erodes the health of its victims, raising blood pressure and even causing post-traumatic stress disorder. Worst of all, most bullies eventually succeed in driving out their victims, provoking them to quit, or finding insidious excuses to get them fired which have nothing to do with their actual work performance. Here is yet more proof that the corporate world is truly a confederacy of dunces...

"Companies must deal with workplace bullies or lose brightest employees" from CBC News

"A woman's approach to being the boss" from the Miami Herald

"Workplace Bullying" from Wikipedia

"Putting A Workplace Bully Back In Line" from WebMD

The Workplace Bullying & Trauma Institute web site

Thursday, June 01, 2006

A Streetcar Named Disaster

Corporate interests bear more responsibility for the likes of Hurricane Katrina than they will ever admit. As we grapple with the consequences of global warming, we should do well to remember a little known episode in the history of corporate malfeasance. In 1949, General Motors, Firestone and Standard Oil were convicted of conspiring to replace the clean and efficient electric tram systems of California with bus lines that polluted the air with toxic fumes. The conspirators had labored for more than a decade to engineer the victory of the internal combustion engine, illegally extracting agreements from public transportation providers never to purchase equipment that did not use petroleum. Sadly, fines imposed by these convictions were minimal, and the effects were nil. Nothing could stop the inexorable replacement of pristine electric crackle with carbon monoxide. GM spent another six years acquiring electric rail companies only to refit them with bus lines and diesel locomotives. By 1974, GM's efforts had helped destroy the electric rail systems of more than one hundred American cities. What rail systems remained used diesel engines almost exclusively while those of Europe and Japan had long ago switched to electricity. It wasn't the craving of the American public that created our "addiction" to petroleum, but the deliberate and unlawful efforts of American greed. Let us damn the pusher, not the addict.

"Road To Perdition" from The Nation